What can you learn from the early adopters of telehealth?

The Advisory Board Company, a consulting best practices firm, recently interviewed several health systems who are at the forefront of telehealth adoption to gain insights on telehealth adoption, acceptance and use cases.

Here’s what they found:

Views on Telehealth

There are essentially two camps of telehealth adopters: vision adopters and business case adopters. These two groups are primarily separated by differing expectations regarding the return on investment and alignment to corporate strategy.

|

Vision Adopters |

Attribute |

Business Case Adopters |

| Organization-wide recognition that DTC telehealth plays a vital role in the changing reimbursement landscape and growing role of consumerism in healthcare. |

Alignment to Strategy |

Believe that telehealth provides a competitive advantage for one or more key departments. |

| Greater focus on strategic benefits in access, quality and patient experience versus immediate financial return. |

ROI Approach |

Require a positive direct financial return or a clear path to in-direct financial return. |

| Focus on provider innovation for the next set of use cases and a willingness to experiment with simultaneous use cases. |

Rollout Strategy |

Focus on use cases that are expected to provide a positive return on investment in the short- or medium-term. |

Both types of organizations are in agreement in how they view the potential of telehealth. These leaders:

- Utilize DTC telehealth as an enabler of strategy, not a strategy itself

- Innovate across multiple use cases to maximize their investment

- Place significant emphasis on education to both consumers & providers

Current Use Cases

Across the board, early adopters are using their telehealth platforms to launch urgent care visits to start, but they’re not relying on DTC telehealth solely for urgent care issues. As they launch an urgent care service, these organizations are envisioning their next set of applications in such areas as:

- Post-surgical follow-up appointments: Orthopedics, neurosurgery, general surgery, cardiac surgery

- Specialty video consultations: Neurology, autism screening, sleep, orthopedics, heart and vascular, head and neck

- Virtual clinics: Catering to targeted patient populations in behavioral health, rheumatology, nutrition, lactation support, and pediatrics

Expected Benefits

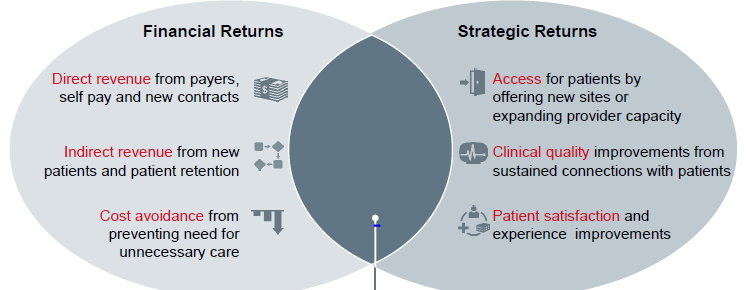

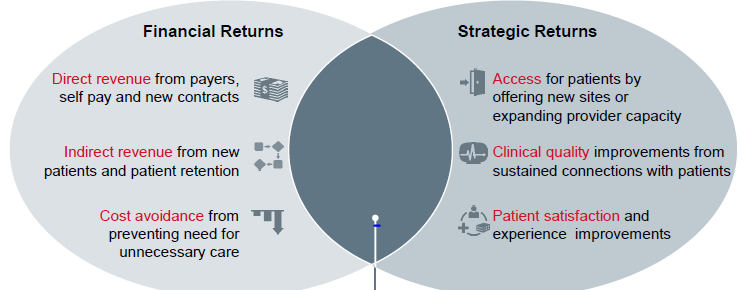

Regarding their expected returns, early adopters anticipate both financial & strategic benefits:

Promotion & Education

A key insight that emerges from these telehealth pioneers is their deliberate and extensive efforts to promote telehealth both internally to their providers and staff, as well as externally to consumers.

For consumers, health systems use multiple channels to drive adoption:

- Owned and earned media

- Digital

- Paid targeted ads

- Reward incentives

- Provider-led introductions to their patients

For providers and staff, efforts focus on building provider acceptance to drive innovation and scale:

- Early clinical engagement in decision-making and operational rollout to gain buy-in

- Inclusion of physicians and staff to design workflows and clinical protocols

- Involvement of executive and clinical leadership to communicate telehealth goals and encourage education & training

These insights provide health systems with a glimpse into telehealth utilization by early adopters. As telehealth continues to evolve, we can expect these industry pioneers to set more standards for future innovation and growth.

Interested in learning more about adopting telehealth? Check out our webinar with The Advisory Board on Unlocking the value of Direct-to-consumer telehealth.

Note: The Advisory Board Company is a partner of Amwell.